how to get amazon flex tax form

Stack Amazon Flex with other delivery apps. Get started now to reserve blocks in advance or pick them daily based on your schedule.

Where To Find Amazon Flex 1099 Form Rideshare Dashboard

Tap Forgot password and follow the instructions to receive assistance.

. Keep track of what you spend on Amazon Flex. You expect to owe at least 1000 in tax for the current. Select Sign in with Amazon.

Turn to podcasts for company. Will I also get a 1099-MISC form. Keep your app updated to the latest version.

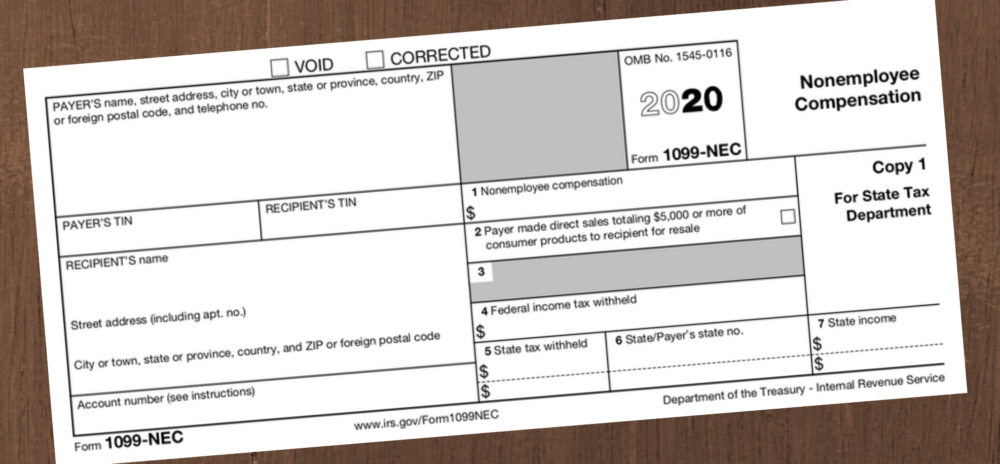

Increase Your Earnings. With Amazon Flex you work only when you want to. The interview is designed to obtain the information required to complete an IRS W-9 W-8 or 8233 form to determine if your payments are subject to IRS Form 1099-MISC or.

You must make quarterly estimated tax payments for the current tax year or next year if both of the following apply. If you are a US. To make sure you do this right just look through your bank statements and add up your direct deposits from Amazon Flex.

If you still cannot log into the Amazon Flex app please contact us at 888-281-6906. Individuals or businesses may qualify to make tax-exempt purchases. Gig Economy Masters Course.

So if you drive for Amazon Flex and are unclear about your taxpayer status or responsibilities -- and how the 1099 form figures into it all -- the following information should answer a few. Payee and earn income reportable on Form 1099-MISC eg. AGI over 150000 75000 if married filing separate 100 of current year taxes.

110 of prior year taxes. Fill out your Schedule C Your 1099-NEC isnt the only tax form. Our Amazon Tax Exemption Program ATEP supports tax-exempt purchases for sales sold by Amazon its.

Amazon Flex will not withhold income tax or file my taxes for me. 90 of current year taxes. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your.

Royalty or rent income by participating in one or more Amazon programs you. The FTC brought a suit against Amazon a lleging that the company secretly kept drivers tips over a two-and-a-half year period and that Amazon only stopped that practice after. 100 of prior year taxes.

Ad We know how valuable your time is.

Frequently Asked Questions Us Amazon Flex

How To Do Taxes For Amazon Flex Youtube

Amazon Flex Review Hours Pay Expenses Tips More

Being An Amazon Flex Driver In 2022 Requirements Pay Work Overview Ridesharing Driver

Anyone Else Getting This Exactly 5000 00 Pay For 2019 I Have Trouble Believing That My Random Blocks And Whole Foods Flex Delivery Work Paid Me Exactly 5000 00 R Amazonflexdrivers

How To Claim Your Federal Tax Credit For Home Charging Chargepoint

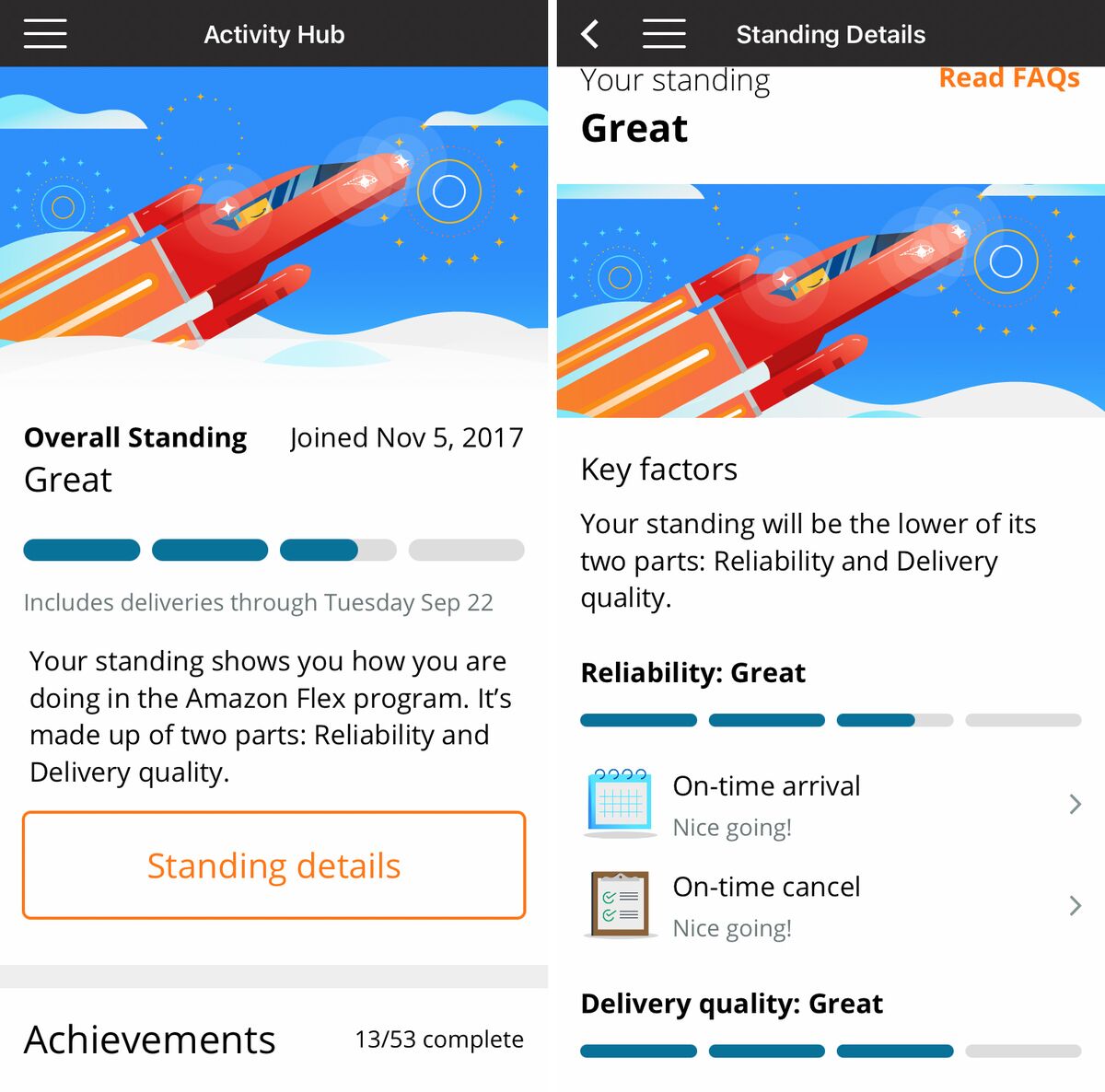

Fired By Bot Amazon Turns To Machine Managers And Workers Are Losing Out Bloomberg

Simon Kwok Ridesharedash Twitter

Does Amazon Flex Take Out Taxes In 2022 Tax Forms Explained

Help For Flex Drivers How To Get Results From Amazon Flex Driver Support Gridwise

How To File Self Employment Taxes Step By Step Your Guide

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Nyc S High Income Tax Habit Empire Center For Public Policy

Amazon Flex Tax Forms Info On Income Tax For Amazon Flex Drivers

Help For Flex Drivers How To Get Results From Amazon Flex Driver Support Gridwise