tennessee auto sales tax calculator rutherford county

Dekalb County James L Jimmy Poss 732 S Congress Blvd Rm 102. This amount is never to exceed 3600.

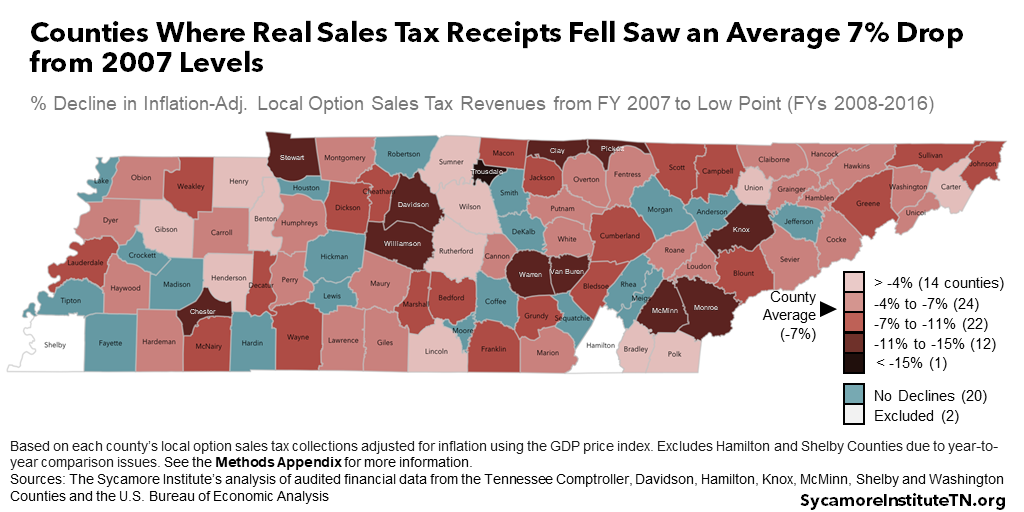

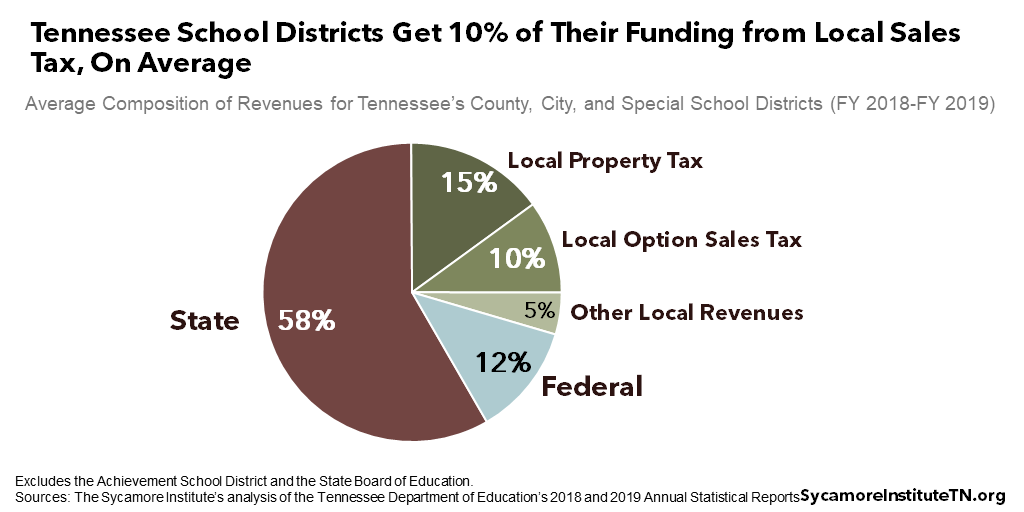

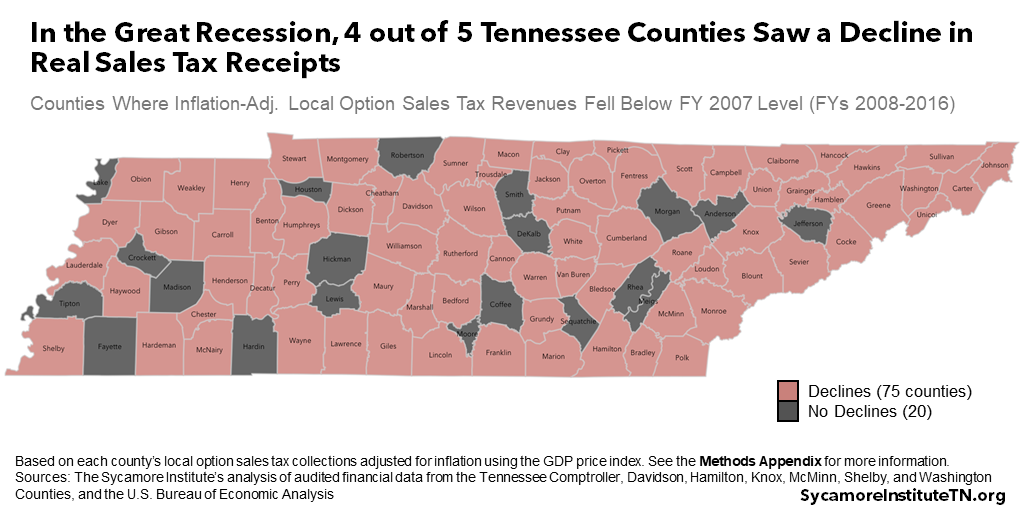

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Typically automobile and boat sales in Tennessee are subject to sales or use tax.

. The minimum combined 2022 sales tax rate for Rutherford County Tennessee is. County Clerk Lisa Duke Crowell Elected Official. The Putnam County Tennessee Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Putnam County Tennessee in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Putnam County Tennessee.

The rutherford county tennessee sales tax is 975 consisting of 700 tennessee state sales tax and 275 rutherford county local sales taxesthe local sales tax consists of a 275 county sales tax. The following information is for Williamson County TN USA with a. The median property tax on a 15710000 house is 116254 in Rutherford County.

County Clerk Lisa Duke Crowell Elected Official. Purchases in excess of 1600 an additional state tax of 275 is added up to a. Local Sales Tax is 225 of the first 1600.

The Rutherford County Sales Tax is collected by the merchant on all qualifying sales made within Rutherford County. Total purchase price multiplied by the 7 percent state sales tax rate. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614. The Rutherford County sales tax rate is. You can find more tax rates and allowances for Rutherford County and Tennessee in.

Tn auto sales tax calculator. Rutherford County TN Sales Tax Rate. There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes.

The median property tax on a 15710000 house is 164955 in the United States. Rutherford County in Tennessee has a tax rate of 975 for 2022 this includes the Tennessee Sales Tax Rate of 7 and Local Sales Tax Rates in Rutherford County totaling 275. 3 rows TN Auto Sales Tax Calculator.

Tennessee car payment calculator with amortization to give a monthly breakdown of the principal and interest that you will be paying each month. Renew in person or by mail. Tennessee auto sales tax calculator rutherford county Saturday March 12 2022 Edit.

Suite 121 Murfreesboro TN 37130 Phone. State Sales Tax is 7 of purchase price less total value of trade in. This will give you the amount of the county property tax bill for this particular property.

The total sales tax you pay for a car in Tennessee is a combination of state and local taxes calculated by adding together. This calculator can only provide you with a rough estimate of your tax liabilities based on the. In addition to taxes car purchases in Tennessee may be subject to other fees like registration title and plate fees.

Murfreesboro 319 N Maple St. Suite 121 Murfreesboro TN 37130 Phone. Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Tennessee Auto loan calculator is a car payment calculator with trade in taxes extra payment and down payment to calculate your monthly car payments. The base state sales tax rate in Tennessee is 7. Tennessee car sales tax rutherford county.

You have the option to see your loan payments. 10000 subtract total vehicle sales price 25300 25300 x 7 state general rate 1771. The Rutherford County Tennessee sales tax is 975 consisting of 700 Tennessee state sales tax and 275 Rutherford County local sales taxesThe local sales tax consists of a 275 county sales tax.

Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10. Fee for transferring plate and title is 1750 300. 2022 Business Information Systems.

Find your Tennessee combined state and local tax rate. The December 2020 total local sales tax rate was also 9750. Between spouses siblings lineal relatives parents and children grandparents and grandchildren great grandparents and great grandchildren or spouses of lineal relatives.

Blountville TN 37617. The Tennessee state sales tax rate is currently. Local tax rates in tennessee range from 0 to 3 making the sales tax range in tennessee 7 to 10.

Rutherford County collects a 275 local sales tax the. Tennessee car sales tax rutherford county. The one stop shop for the citizens of Davidson County Tennessee to renew their drivers license get a business license get a marriage license and much more.

The few exceptions to this rule are when vehicles or boats are sold. Total vehicle sales price 25300 25300 x 7 state general rate 1771 Total tax due on the vehicle 1851 if purchased in Tennessee Minus credit for 1518 FL sales tax paid must be on bill of sale 333 tax still due at time of registration. The median property tax on a 15710000 house is 106828 in Tennessee.

The current total local sales tax rate in Rutherford County TN is 9750. Local collection fee is 1. Tennessee state sales tax is 7 percent of a vehicles total purchase price.

Sales Tax Calculator 2022 Davidson County Clerk. What Are Tennessees State City and County Sales Tax Rates. Home auto county rutherford tax.

Vehicle Sales Tax Calculator. From a sole. Murfreesboro 319 N Maple St.

The first 1600 multiplied by the sales tax of the. Clarksville Police Are Looking For Damien Gray With Warrants Clarksville Online Arrest Burglary Clarksville Rutherford County Sheriff Tn Police Patches Fire Badge Emergency Management. Tennessee collects a 7 state sales tax rate.

Vehicle Sales Tax Calculator. This is the total of state and county sales tax rates. WarranteeService Contract Purchase Price.

H Plates For Hire Non Apportioned Vehicle Services County Clerk Guide

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Covid 19 Birx To Retire After Tumultuous White House Tenure The New York Times

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

County Clerk Sales Tax Calculator Rutherford County Tn

Tennessee Car Sales Tax Everything You Need To Know

Moody S Esg Insights Analysis Us Automotive Manufacturing Hubs Exposed To Climate Risk

Tennessee County Clerk Registration Renewals

Good Read Friendly Business Climate Heats Up Economy In Rutherford County Tn Economic Development Manufacturing Livability

Moving To Williamson County Tn 12 Things To Know 2022 Guide

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee County Clerk Registration Renewals

Tennessee County Clerk Registration Renewals

County Clerk Sales Tax Calculator Rutherford County Tn

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Sales Tax Rates By City County 2022